Credit Union Australia Ltd is a member owned organisation. We report against the ASX Corporate Governance Principles and Recommendations.

Our Board is responsible for developing and guiding a viable, mutually owned business that delivers on the Purpose of helping every Australian own their own home.

The Board provides oversight and guidance to the leaders of the organisation. The Board Charter and Board Instrument of Delegations set out the respective roles and responsibilities of both our Board and leaders.

Our Constitution outlines the process by which directors are appointed, including how our members can nominate to join the Board. Should an election of directors be required at the Annual General Meeting (AGM), members are provided with information to assist them in determining their voting preference.

Each year, we evaluate the performance of the Company, the Board as a whole, and each individual Director.

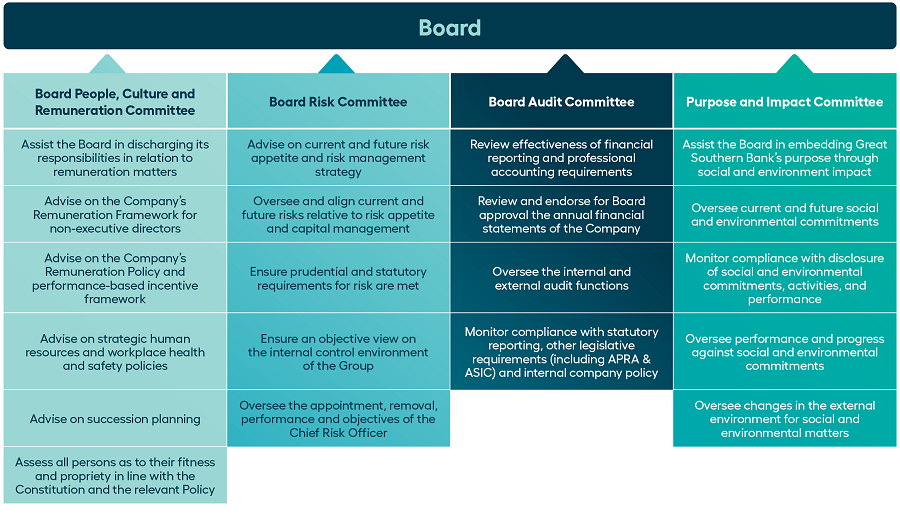

Each director’s experience, committee memberships, other directorships and length of service, is published on our website. The Board has established four committees to support its governance. Each committee has a Charter defining its roles and responsibilities and is comprised of independent directors. The Audit and Risk Committees must be chaired by an independent, non-executive director other than the Chairman of the Board.

The number of Board and Committee meetings conducted, as well as the attendees at those meetings is disclosed in the Annual Report.

Our expectations on culture and values are driven by our Purpose and our code of conduct, Ethics and Integrity in Practice.

Our Executive leaders provide the Board with an annual declaration that, in their opinion, our financial records have been properly maintained and:

- That the financial statements comply with the appropriate accounting standards;

- Give a true and fair view of our financial position and performance; and

- That the opinion has been formed based on a comprehensive and effective system of risk management and internal control.

As its owners, our members are welcome to attend and vote at the AGM. They can also access information about our governance on our website, or by contacting the Company Secretary. Members have the right to opt in or out of receiving information and/or notifications about our governance and corporate life.

Our Risk Management Framework follows the Three Lines of Defence model.

The Board reviews the Risk Appetite Statement and Risk Management Strategy annually.

The Board Risk Committee, along with the Board People, Culture and Remuneration Committee, have oversight of our risk culture. We always look to work towards our purpose, this is why we exist and this sets how we interact with all of our stakeholders.

The Board People, Culture and Remuneration Committee oversees our remuneration framework. Other key matters addressed by the Board People, Culture and Remuneration Committee are as follows:

- Corporate Culture

- Talent & Succession planning

- Learning & Development

- Safety Health & Wellbeing

- Board & Director matters

Our Board Risk Committee has oversight of the Business Continuity Plan, along with any increased risk management activities implemented as a result of local or global events - such as COVID-19. It is also responsible for managing potential disruption to business operations and establishing enhanced reporting measures to ensure that our Board remains fully informed.

Our Board is responsible for safeguarding the governance and viability of the Great Southern Bank, including any re-assessment of the Great Southern Banks’s strategic direction.

| Board People, Culture and Remuneration Committee | Board Risk Committee | Board Audit Committee | Purpose and Impact Committee | |

|---|---|---|---|---|

| Chair | Deborah O'Toole | Kyle Loades | Mark Hand | Louise McCann |

| Members |

Nigel Ampherlaw Louise McCann |

Mark Hand Louise McCann Wayne Stevenson Peeyush Gupta |

Kyle Loades Deborah O’Toole Wayne Stevenson Peeyush Gupta |

Deborah O’Toole Wayne Stevenson |

We ensure that our Corporate Governance Framework remains fit for purpose. However, these policies, rules, procedures and processes are not a substitute for a Board, leadership team and team members focused on ‘doing the right thing.’ Over and above Corporate Governance, our Purpose is the centre of all we do and determines our unique culture.